Member Resources

Benefit Management Administrators gives plan members tools for managing their health and the health of their families.

Health Benefits Portal

Using the Benefit Management Administrators web portal, you can access your claim details, healthcare plan info, and health & fitness resources.

There are also tools in our web portal to find a provider or access support for diagnosis-specific treatment guidance and management.

Search for: BMA Health Spending Account

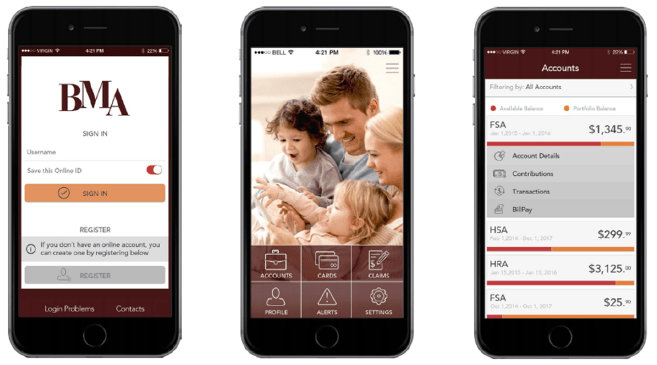

Access FSA Account Balances on the Go

Plan members can access their FSA account using their smartphone or tablet

BMA's Flexible Spending mobile app gives members their account information anywhere, at any time. With the mobile app, you have access to:

- Account Balances

- Transaction History

- Submit Claims

- Upload Receipts for Claims

- Display Claim Receipt Notification

- Manual claim

- Reimbursement Letters

- Pay Bills

- Request Reimbursements

- Manage Debit Cards

- Real Time Alerts

- Account Communications

- Update Profile

- Communication Settings

- Reimbursement Settings

Reimbursement Benefits fund a variety of healthcare-related products and services for you, your spouse, and eligible dependents.

Flexible Spending Account

Flexible Spending Accounts (FSA) are a “use it or lose it” account that resets every year. You may have an FSA account but may want more information before using the money.

Health Savings Account

Health Savings Accounts (HSA) can roll over from year to year and accumulate in your savings deposit. You may have an HSA account but may want more information before using the money.

Health Reimbursement Account

Reduce your out-of-pocket healthcare expenses by leveraging the health reimbursement arrangement from your employer.

Use your Reimbursement Benefits to pay for a variety of healthcare-related products and services for you, your spouse, and eligible dependents.

Enroll in an HSA and save on eligible health expenses.

You may be surprised what qualifies.

COBRA

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer continuous health care coverage to employees and their dependents who would otherwise lose their coverage due to termination of employment or other factors.

Here are answers to the most common questions about COBRA.

- What is COBRA coverage?

- The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a continuation of group health plan coverage for a qualified individual who might otherwise lose coverage under a group health plan.

- How do I get on COBRA?

- COBRA has basic requirements to be eligible. An eligible qualified beneficiary (QB) is one who loses group health plan coverage due to a qualifying event. The QB may elect to continue group health plan coverage for a limited time on a self pay basis.

- What are Qualifying Events?

- A Qualifying Event (QE) is generally when a triggering event causes a loss of health plan coverage. There are 7 triggering events:

- Termination of Employment or Reduction in hours.

- Birth or adoption

- Death

- Marriage or Divorce

- Child gains or loses dependent status

- Gains or loses Medicare or Medicaid coverage

- Qualifying Medical Child Support Order

The qualifying event must cause the QB to lose coverage.

- A Qualifying Event (QE) is generally when a triggering event causes a loss of health plan coverage. There are 7 triggering events:

- How long can I stay on COBRA?

- COBRA requires that continuation coverage extend from the date of the qualifying event for a limited period of 18 or 36 months. The length of time depends on the type of qualifying event that gave rise to the COBRA rights. A plan, however, may provide longer periods of coverage beyond the maximum period required by law.

- Can a family member or friend call and ask questions for me?

- BMA follows and adheres to HIPAA regulations and we will not be able to talk to anyone regarding your account unless they are an adult on the account or we receive written permission from you that we are allowed to release information to that named person.