The Problem

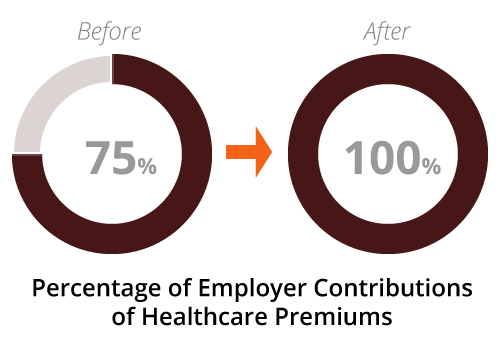

Mary has single coverage through her employers benefit plan. Mary’s employer pays 75% of her health care premiums, while she picks up the remainder.

Due to a significant increase in premiums the following year, Mary’s employer makes changes in their schedule of benefits to compensate the changes in costs.

Mary is given two choices with the new changes:

- (a) Mary may move to a high deductible health plan where her employer will pay 100% of her premiums

- In addition to choice (a), her employer is willing to set up and contribute to a Health Savings Account (HSA).

- (b) she must pay a significant amount more to retain her current low deductible plan.

The Result

Mary’s employer saves money on the cost of the original plan, and renewals return to a competitive number. Mary saves money in a portable interest bearing account that she can tap into to cover her healthcare costs, as needed (No Use It or Lose It) and she becomes a more cost conscious, informed consumer.